I recently decided to activate my online Pag-IBIG account but I didn’t use a loyalty card plus member. Instead, I visited the branch!

For those who don’t have a loyalty card plus member yet, you can visit the nearest branch. That’s exactly what I did!

Pag-IBIG has stepped up in providing online services to their members thru Virtual Pag-IBIG. Using this online account, members can activate their online Pag-IBIG account, monitor their contributions and savings! Is there a better feeling than seeing how much you saved over the years?

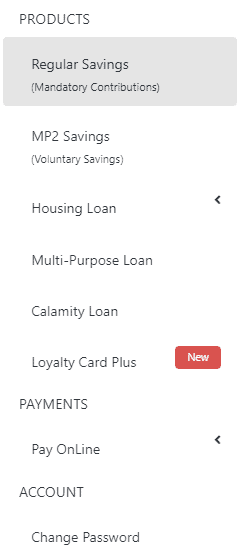

You can only do this if you have your online account, also called as Virtual Pag-IBIG. Members are encouraged to active online Pag-IBIG account to enjoy the following:

- Monitor their contributions: Check if your employer’s remittance on your benefits.

- Enroll and check MP2 Savings: You can set up a new savings account with guaranteed dividends.

- Pay online: This time, you can pay for your contributions online!

- Loan inquiries: If you plan to apply for a home loan soon, this will be very helpful!

- Link Loyalty Card Plus: It’s better to get one since it serves as an ATM card (Union Bank or AUB) for members.

Here are the things you can do to activate online Pag-IBIG account:

- Apply online.

- Visit the nearest branch.

- Confirm your online information.

- Check and consolidate your contributions if needed.

- Start using your virtual Pag-IBIG account.

Apply Online

To activate your online Pag-IBIG account, the first step is to visit the website. There has been a massive improvement in this service since the last time I checked it. In December 2019, the website has been officially launched to maximize the services.

View the website by clicking here.

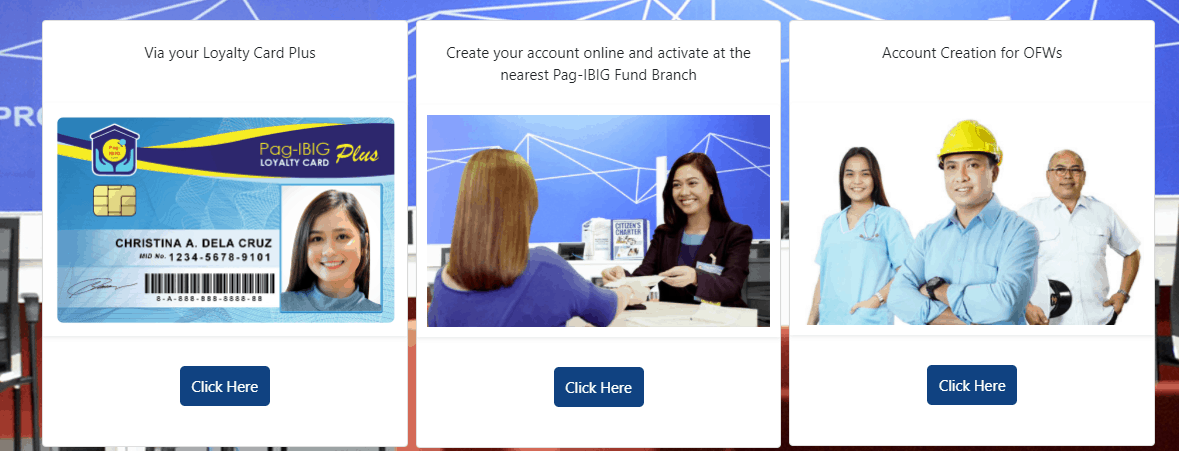

You will see three options to activate your online Pag-IBIG account. You can do it via Loyalty Card Plus, nearest branch, or OFW creation. Click the middle since we aim to visit the nearest branch.

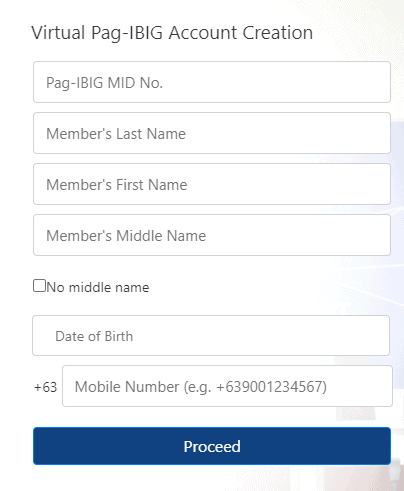

After clicking the right option for you, fill out the form with the following information:

- Pag-IBIG MID No. (12 digits, no special characters)

- Last Name

- First Name

- Middle Name

- Date of Birth

- Mobile Number

Note: Be careful in clicking No Middle Name. It can cause problems in your account.

Once you click Proceed, you will receive an SMS confirmation that you can visit the nearest branch.

Visit the Nearest Branch

Although Pag-IBIG sites in the mall are very accessible, it’s better to look for the branch instead. Offices in the mall don’t accommodate these requests, at least inside Alimall. I went straight to the Cubao Branch, which is in front of the mall office.

The queue can be very long especially in the morning. In our case, I arrived at the place at 9:30AM and got in at 10:30AM! 1 hour is not bad, though. Just make sure to tell your purpose to the information center so you can be provided of the right queue number for the counter.

For the list of branches, click the following:

Luzon Branch – Office Directory

Visayas Branch – Office Directory

Mindanao Branch – Office Directory

Confirm your Online Information

After another hour of waiting for the counter queue, I was able to talk to the officer! Fortunately, the officer was very accommodating and helfpul on what I should do.

I confirmed the other details such as my e-mail address (probably the most important one), mobile number, and current address.

Once confirmed, the officer will tell you if it’s processed.

Check your e-mail if you have received a confirmation from Pag-IBIG. Click the link, and enter your temporary password to change it to your preferred security option.

Check and consolidate your contributions if needed

Do I need this for to activate online Pag-IBIG account?

It’s not an essential step but since you’re already in the branch, you might as well do it. In your virtual Pag-IBIG account, you will see the contributions from your salary and your employer. I believe Pag-IBIG still needs to work on making the contributions standardized.

In your SSS account, you don’t need to worry about overlapping contributions from various employers since they’re standardized. For Pag-IBIG account, consolidation is a must.

List down all your employers or voluntary contributions. Submit the list and allow 1-2 months of doing so. Please follow up as they’re not sometimes processed completely.

Start using your virtual Pag-IBIG account

That’s it! You’ve completed the process to active your Pag-IBIG online account.

You can now enjoy the benefits of using your virtual Pag-IBIG account. Check your contributions, and monitor your MP2 Savings.

It’s very easy to use and my favorite is the ability to pay online. For voluntary members, you don’t need to visit the branch. Pay online using your card. It’s consolidated immediately as well and saves someone from the inconvenience of visiting the branch again.

FAQ’s on Virtual Pag-IBIG

Can I use it to pay for my MP2 Savings?

Yes, you may! Similar to the regular contributions, you can also pay your MP2 account using your virtual Pag-IBIG.

I do have an existing house loan. Will I see it virtual Pag-IBIG?

Members can also see or monitor their existing house loan.

Is it possible to link my existing loyalty card plus member?

Yes! You will see the section for your loyalty card plus member. Click link account.

Comment your question or share your experiences.