Keep these money saving hacks and be financially responsible as early as now.

Student life comes with different responsibilities. Most of the time, we find ourselves tight on our budgets because of the times we become a little bit unmindful about our finances.

If you want to find out ways to pinch pennies and be more financially responsible as a student, we listed down some money saving hacks below.

1. Understand your needs and your wants.

All money saving hacks start from this!

More often than not, many of us tend to put the things we want before the things that we need. Maybe you’ve bought merchandise from one of your idols before you bought a required textbook for your class. It is very important that we see things clearly and differentiate the things we can and cannot go without.

Generally, the mistake of putting wants before needs happens during impulse buying, especially during a discount period or sale promotion. One way to minimize this mistake is the money saving hack of practicing the three-day rule. Before checking out an item, reflect for three days on whether or not you should buy it.

By the end of this period, you should be able to distinguish whether it is worth your money or not.

2. Set a daily, weekly or monthly budget.

To avoid petsa de peligro in between the days of receiving your allowance, make sure to account for every expense you are to make.

Include not only the costs for the basics like school materials, rent, groceries, utilities and the like, but for those leisurely activities such as afterschool hangouts at the milk tea shop or the necklaces and scrunchies you bought online.

Planning out all of these expenses is an important money saving hack since you can visualize your spending habits and you would know which expenses you can cut down on if you have to.

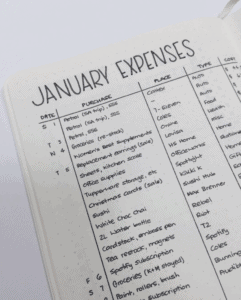

3. Track your expenses.

After setting your budget for certain things, take note of the things you spend on. You can keep receipts, write them down in a notebook or use an app. This is an important money saving hack since it checks the effectivity of the budget you set.

Often, there are certain expenses that go over our heads and we forget about them while setting a budget, and tracking expenses as they happen can help us set our budget more accurately.

Also, this money saving hack can help us review our actual spending habits, and allow us to check what we could cut down on when it comes to spending. For example, instead of buying a bottle of water every day, bringing water from home could help cut down that expense.

4. Establish a goal for your savings

In order to motivate yourself into sticking to the budget and tracking your expenses, set a goal for your savings and put it aside for a rainy day. In that way, you can feel comfortable and satisfied that you are managing your money well. It doesn’t always have to be a grand amount, but just enough to feel like you’ve done something good for yourself.

5. Don’t miss out on deals

Find ways to make every peso worth it. It pays to be stingy.

- Instead of buying textbooks, try and see if you can rent from other students.

- Check for discounts on food while getting groceries, remember to be wary about the expiration dates though.

- When paying bills, some apps like GCash offer cashback promotions

- Put store memberships to good use, collect points and use the rewards to your advantage. For example, a membership at 7 eleven could get you free meals for when you are especially tight on your budget.

- Ask if student discounts are available.

6. Practice self-discipline, which is the most important among the money saving hacks you can find.

No matter how much you understand the difference between needs and wants, track your expenses or set your goals, it all boils down to sticking to these habits.